Singapore

Chinese generic drug firms face stiff competition from Indian drugmakers

They offer lower labour costs and stronger R&D capabilities.

Chinese generic drug firms face stiff competition from Indian drugmakers

They offer lower labour costs and stronger R&D capabilities.

OUE Lippo Healthcare buys 70% stake in Wuxi Bohai Hospital for $1.9m

The Grade II hospital has 100 beds.

Top five healthcare stocks in Singapore averaged total returns of 29.5% YTD

ISEC leads the pack at 48.6%.

Singapore, Philippines spearhead medtech across SEA

The Lion City’s Diagnostics Development hub has delivered 400 technologies and four products since 2014.

HC Surgical Specialist profits up 38% to $880,000 in Q1

New acquisitions from the previous financial year brought growth.

10 in 11 APAC healthcare groups saw negative shareholder returns in 2016-2018: Bain

Rising costs, evolving regulations and reimbursement pressure eroded profits.

APAC's employer medical benefit costs may rise 8.7% in 2020

This growth will be led by Malaysia and Thailand.

Singapore lost $1.04b to migraines in 2018

Patients who experienced it for four to 14 days per month lost an average of $14,860.

Singapore telehealth firm inks deal with Vietnamese insurer

Bao Minh's customers can consult with a doctor on their phones.

Childhood vaccination in Singapore to be subsidised in CHAS general practitioner clinics

Subsidies will available in both polyclinics and CHAS clinics by end-2020.

Singapore medical device output grew 4.2% in June

The industry outperformed the output of the manufacturing sector, which fell 6.9%.

94% of Singapore firms attach international medical plans to healthcare programmes

This comes as employees seek more comprehensive plans to reduce out-of-pocket costs.

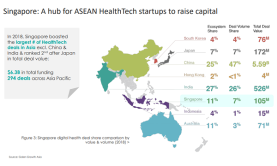

Singapore clinched $145.78m of healthtech deals in 2018

The city trails only behind China and India in terms of deal value.

Asian healthtech deals hit $2.5b

$595m went to firms geared towards health management solutions.

The chatbot will see you now – virtual HCP engagement in the Asia Pacific

There is little doubt that the Asia Pacific region represents a key growth ambition for the majority of Life Sciences companies. Statistics around unmet healthcare needs are well-known and, as the saying “necessity is the mother of innovation” goes to show, the Asia Pacific has an opportunity to leapfrog the West when it comes to novel therapies and approaches to market access. But at the same time, cost control and compliance remain sizeable challenges.

IT budgets could shrink for half of life sciences firms

Only 15% of life sciences firms believe digital tools could enhance customer experience.

Top three healthcare firms in Singapore averaged total return at 31.2% in January-July 2019

These three firms’ average dividend yield came at 3.3% over the same period.

Advertise

Advertise